When applying for a home loan, your CIBIL score is one of the most important factors lenders consider. This score reflects your creditworthiness and influences whether you qualify for a loan, as well as the interest rate offered. Understanding how CIBIL score calculation works and knowing how to improve your CIBIL score can make a significant difference when you opt for a housing loan.

In this article, we will explore the factors that influence CIBIL score calculation, how it impacts your eligibility for home finance, and tips to enhance your credit score.

What is CIBIL Score Calculation?

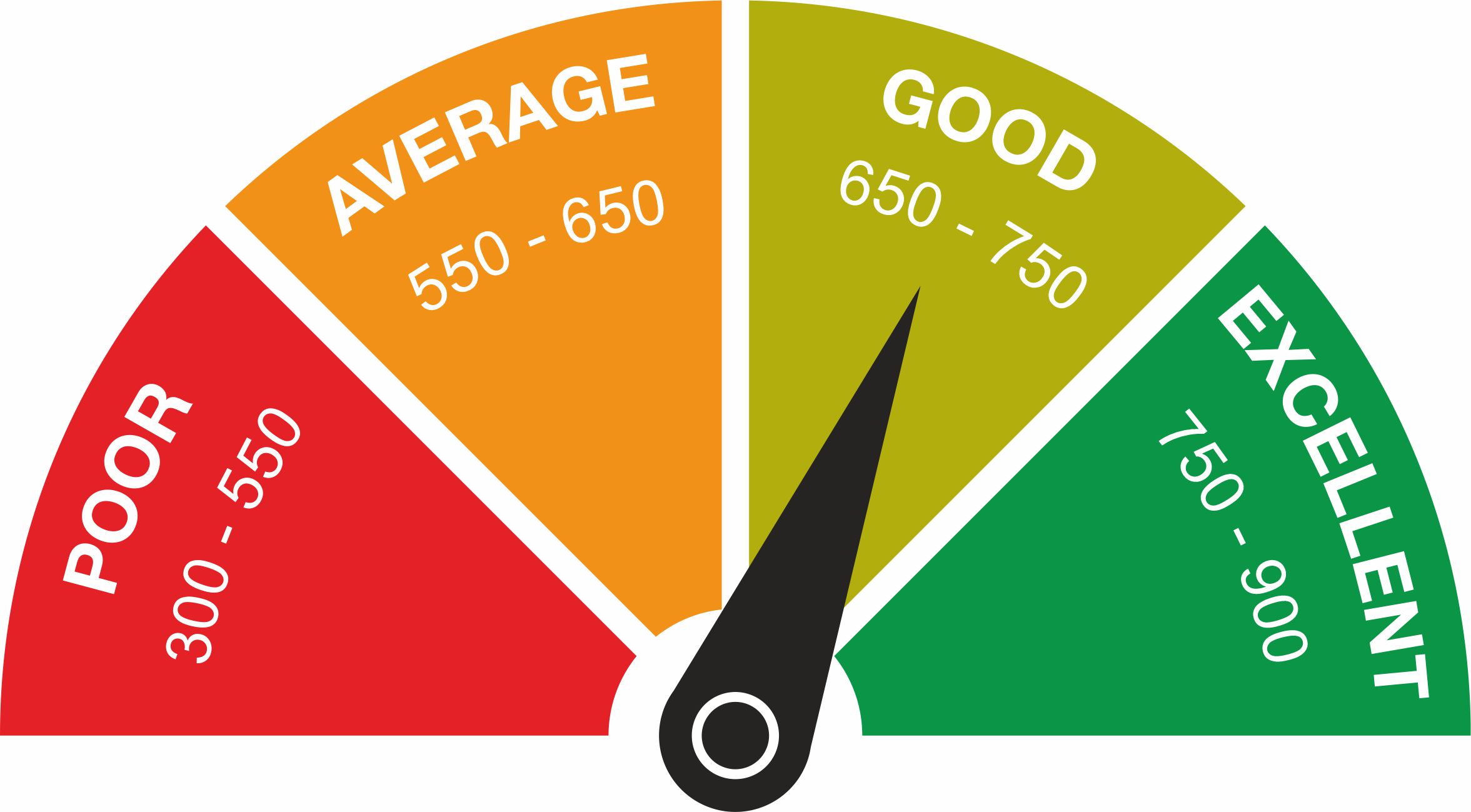

The CIBIL score is a three-digit number ranging from 300 to 900 that represents your credit history and financial discipline. It is calculated by the Credit Information Bureau (India) Limited, using data from your credit report, which includes your loan and credit card repayment history, credit utilisation, and credit inquiries.

A higher CIBIL score, closer to 900, indicates a lower risk for lenders, making it easier for you to qualify for a loan with better terms. Scores closer to 300 indicate a higher risk, and lenders may hesitate to approve a loan or offer it with stricter conditions.

Factors that Influence CIBIL Score Calculation

Understanding how your CIBIL score is calculated is the first step towards maintaining or improving it. Here are the main factors that impact your score:

- Repayment History (35%): Your repayment history plays the biggest role in CIBIL score calculation. Timely payments of EMIs, credit card bills, and other loans positively affect your score, while missed or late payments can bring it down.

- Credit Utilisation (30%): This refers to the percentage of your credit limit that you are using. Keeping your credit utilisation low, ideally below 30%, improves your CIBIL score.

- Length of Credit History (15%): The longer your credit history, the more reliable your score will be. Consistent, responsible credit behaviour over a longer period has a positive impact.

- Credit Mix and Type (10%): A balanced mix of secured loans (such as home loans) and unsecured loans (like personal loans or credit cards) can boost your score. Having too many unsecured loans can have a negative impact.

- Credit Enquiries (10%): Every time you apply for credit, the lender makes a hard inquiry on your credit report. Multiple hard inquiries in a short period can lower your CIBIL score, so avoid frequent applications for credit.

How CIBIL Score Impacts Your Eligibility for Home Finance

Your CIBIL score is a key factor in determining whether you are eligible for a home finance option and under what terms. Here’s how different score ranges can impact your loan application:

- 750 and above: A score in this range makes you an attractive borrower. Lenders are more likely to approve your loan quickly, offer better interest rates, and provide more favourable loan tenors.

- 700 to 749: This range is still good, and most lenders will approve your loan, though you may not get the lowest interest rates.

- 650 to 699: Lenders may approve your loan but with higher interest rates, and they might impose stricter conditions.

- Below 650: A score in this range makes it difficult to secure a home loan. Lenders may reject your application or offer unfavourable terms, such as high interest rates and shorter tenors.

Thus, improving your CIBIL score before you opt for a housing loan can save you money and make the loan process smoother.

How to Improve Your CIBIL Score

If your CIBIL score is lower than ideal, don’t worry—there are several ways to improve your CIBIL score and increase your chances of securing a home loan. Here are some tips on how to improve your CIBIL score:

- Make Timely Payments: Pay your credit card bills and loan EMIs on time. Set up reminders or automate payments to ensure you never miss a due date.

- Reduce Credit Utilisation: Aim to keep your credit utilisation under 30% of your total credit limit. This indicates responsible credit management to lenders.

- Avoid Multiple Credit Enquiries: Refrain from applying for multiple loans or credit cards in a short period. Instead, wait for existing applications to process before applying for more credit.

- Maintain a Healthy Credit Mix: Balance your portfolio with both secured and unsecured loans. Too many unsecured loans can lower your score, so it’s better to maintain a mix.

- Check for Errors in Your Credit Report: Regularly check your credit report to ensure there are no errors. Mistakes like incorrect late payments or wrong account details can negatively impact your score.

By following these steps, you can gradually increase your CIBIL score, making it easier to secure a home loan with favourable terms.

The Role of CIBIL Score in Choosing a Home Loan

A good CIBIL score not only helps in getting your loan approved but also gives you access to better loan offers. Lenders offer lower interest rates, flexible tenors, and higher loan amounts to borrowers with high scores. Therefore, before applying for a loan, take the time to assess your credit score and work towards improving it if necessary.

Conclusion

Understanding CIBIL score calculation is essential if you’re planning to opt for a housing loan. Your score directly impacts your loan eligibility and the terms of the loan, including interest rates and loan tenor. By maintaining a strong credit history and making an effort to improve your CIBIL score, you can secure better deals when applying for home finance. Regularly checking your credit report and managing your finances responsibly will set you on the path to successful homeownership.